Switzerland's real gross domestic product (GDP) expanded by 0.6% in the

1st quarter of 2013 compared to the previous quarter, after increasing

0.30% in the last quarter of 2012. Positive contributions to growth came

from private consumption, investments in construction and from the

trade balance, whilst investments in machinery and equipment by contrast

decreased. Value added on the production side increased in a number of

sectors during the 1st quarter; particularly in the areas of industry,

the construction and financial sectors and in some non-financial private

and public-sector services. Real GDP rose by 1.1% compared with the 1st

quarter 2012.

Source by Commodity Insights

Safah Trading is the Best Mcx tips provider.Also providing mcx tips,commodity tips,free mcx,mcx commodity,mcx trading,base metal,commodity free tips,commodity tips free,free commodity tips,copper mcx,free tips mcx,free tips for mcx,free tips for trading,mcx commodity trading tips,best commodity,free mcx trial,mcx free trial,mcx natural gas,commodity free trial,nickel mcx,mcx free trial tips,free mcx tips trial,mcx trading tips,commodity free trial tips in INDIAN COMMODITY MARKET.

Thursday, May 30, 2013

Economic Buzz: Australian Building Permits Jump In April

Australian Bureau of Statistics said that Australian Building

Approvals rose to a seasonally adjusted 9.1%, from -5.5% in the

preceding week. Analysts had expected Australian Building Approvals to

rise to 4.0% last week. On an yearly basis, building permits rose by 27%

in April, after gaining 3.9% in the previous month.

Source by Commodity Insights

Source by Commodity Insights

Friday, May 24, 2013

Economic Buzz: Household Spending Saves Germany From Recession

An increase in spending by consumers and households offset sagging exports and falling investment in Germany in the first quarter, allowing Europe's biggest economy to narrowly avoid recession, official data showed Friday. The federal statistics office Destatis calculated in final data that Germany's gross domestic product (GDP) grew by 0.1 percent in the period from January to March following a contraction of 0.7 percent in the preceding quarter. The data confirm a preliminary estimate already published earlier this month.A recession is technically defined as two consecutive quarters of economic contraction.

A breakdown of the data showed that out of the different GDP components only private consumer spending was positive, growing by 0.8 percent. Public-sector spending slipped by 0.1 percent, investment tumbled 2.4 percent, imports were down 2.1 percent and exports contracted by 1.8 percent, the statisticians calculated. As stated earlier this month, Destatis blamed the unexpectedly weak start to the year to the extreme winter weather conditions.

Source by Commodity Insights

Gold Retreats From Highs Near $1400

Gold..........

MCX Gold futures for June are trading marginally on a bearish note as the global prices retreated in Asian trades after gaining overnight. The equities in Asian are mixed though the bearish undertone in very much evident in Japanese stocks after a massive 7% correction yesterday. Markets are worrying about a possible reversal in ultra easy money policies of the US Fed much earlier than what was expected. The turmoil in equities has been supportive for Gold though. The metal rallied from lows around $1355 per ounce and neared $1400 per ounce yesterday. The counter quotes at $1391.40 per ounce, down 40 cents per ounce on the day right now.

Chinese growth worries came back to the forefront yesterday. China HSBC flash manufacturing PMI for May came in at 49.6, down from 50.4 in April and down from 50.4 expected for May. This is a seven month low back into contraction territory reflects slowing domestic demand within China and global slowness hindering exports. The sentiments were already down after the US Fed minutes and Bernanke comments yesterday. Japanese stocks slipped by more than 7% amid a wild run in government bonds and European stocks are also down around 2%.

US Federal Reserve chairman Ben Bernanke hurt the risky assets on Wednesday by suggesting the current quantitative easing measures that have been pushing US growth could start to taper off as soon as June. His speech tried to balance competing objectives. He said the US economy was improving but headwinds including government spending cuts were dragging on the recovery. He said the job market was improving but it remains weak overall and participation rates are still moving down. However, Gold has been broadly supported after the Fed comments.

The metal has slipped nearly 20% this year as some investors lost faith in the metal as a store of value and amid concern that the Fed may scale back economic stimulus measures. Assets in the SPDR Gold Trust, the biggest bullion-backed exchange-traded product, dropped to 1,020.07 metric tons yesterday, the lowest since February 2009, maintaining an outflow, which has been a perennial feature of gold trade this year. The local gold futures have been supported given the buying in spot markets around Rs 25800-26200 levels. The MCX Gold futures are trading at Rs 26377, down Rs 63 per 10 grams or 0.24%. Prices had briefly hit above Rs 26500 in early moves.

Chinese growth worries came back to the forefront yesterday. China HSBC flash manufacturing PMI for May came in at 49.6, down from 50.4 in April and down from 50.4 expected for May. This is a seven month low back into contraction territory reflects slowing domestic demand within China and global slowness hindering exports. The sentiments were already down after the US Fed minutes and Bernanke comments yesterday. Japanese stocks slipped by more than 7% amid a wild run in government bonds and European stocks are also down around 2%.

US Federal Reserve chairman Ben Bernanke hurt the risky assets on Wednesday by suggesting the current quantitative easing measures that have been pushing US growth could start to taper off as soon as June. His speech tried to balance competing objectives. He said the US economy was improving but headwinds including government spending cuts were dragging on the recovery. He said the job market was improving but it remains weak overall and participation rates are still moving down. However, Gold has been broadly supported after the Fed comments.

The metal has slipped nearly 20% this year as some investors lost faith in the metal as a store of value and amid concern that the Fed may scale back economic stimulus measures. Assets in the SPDR Gold Trust, the biggest bullion-backed exchange-traded product, dropped to 1,020.07 metric tons yesterday, the lowest since February 2009, maintaining an outflow, which has been a perennial feature of gold trade this year. The local gold futures have been supported given the buying in spot markets around Rs 25800-26200 levels. The MCX Gold futures are trading at Rs 26377, down Rs 63 per 10 grams or 0.24%. Prices had briefly hit above Rs 26500 in early moves.

Source by Commodity Insights

Thursday, May 23, 2013

Economic Buzz: New Zealand April Balance Drops

The value of imported goods rose NZD263 million (7.4 percent) to NZD3.8billion in April 2013, compared with April 2012, Statistics New Zealand saidtoday. Petroleum and products led the increase in imports, up NZD235 million,due to crude oil and diesel. Vehicles, parts, and accessories recorded thesecond-largest increase, up NZD68 million. "The value of goods importedrose on the back of petroleum imports, which can fluctuate depending on thetiming of shipments," industry and labor statistics manager LouiseHolmes-Oliver said. "The trade surplus has reduced compared with theprevious four April months." Exported goods rose NZD83 million (2.2percent) to NZD4.0 billion. Meat and edible offal led the rise, followed bypetroleum and products. The trade balance for April 2013 was a surplus of NZD157million (4.0 percent of exports). April months have been in surplus since 2009.After removing seasonal effects, exports decreased 8.6 percent in April 2013,compared with March 2013. Crude oil (which is not seasonally adjusted) led thisdecrease. Seasonally adjusted imports rose 1.5 percent in April 2013.

Source by Commodity Insights

Wednesday, May 22, 2013

Economic Buzz: Japan's Trade Deficit Widens As Imports Surge

Japan's trade deficit widened sharply in April, as export growth was

tepid while imports surged, according to Finance Ministry data released

Wednesday. The trade gap grew to 880 billion yen ($8.6 billion) from

March's ¥364 billion deficit, as exports rose just 3.8% from a year

earlier. Exports to China managed to creep 0.3% higher, but shipments to

the U.S. spiked 14.8%. European Union-bound exports fell 3.5%. The yen

weakened slightly after the data, as the dollar rose to ¥102.43 from

¥102.35 just before the release, with the moves coming ahead of a Bank

of Japan policy decision due later in the day.

Source by Commodity Insights

Source by Commodity Insights

Gold Down As Equities Rally on QE

Gold.......

Gold futures are trading lower as the equities cheered taking the Japanese stocks toward fresh multiyear highs on indication that the Federal Reserve Bank wasn’t close to slowing its asset purchases.

The rally in equity market has recently taken away the shine from gold as investors have taken away their money from gold and other commodities and have invested in the stock market.

U.S. stocks rose on Tuesday, with the Dow industrials and S&P 500 finishing at record highs, after comments from two Federal Reserve officials suggested that the central bank is not close to tapering its bond-buying program. The Dow Jones Industrial Average gained 52.30 points, or 0.3%, to end at 15,387.58, notching its 19th consecutive Tuesday rise. The S&P 500 index climbed 2.87 points, or 0.2%, to 1,669.16,

In Asia, the Nikkei Stock Average, which ended at multiyear highs in each of the last three trading sessions, climbed a further 1.1% to 15,555.82, while the broader Topix added 0.8%.

Gold for June delivery is trading down $2 at $ 1375 an ounce on the Comex division of the New York Mercantile Exchange. It shed $6.50, or 0.5%, to settle at $1,377.60 an ounce, paring losses that had taken prices to a low below $1,360.

On Tuesday, St. Louis Fed President James Bullard said the central bank should continue with its present bond-buying program and adjust the rate of purchases in view of incoming data on growth and inflation. In a separate speech, New York Fed President William Dudley said he’s not sure which way the Fed will adjust the size of its bond-purchase program.

The program has helped support gold as quantitative easing tends to pressure the dollar and can lead to inflation. Gold is often seen as a hedge against inflation.

Fed Chairman Ben Bernanke on Wednesday will testify before the Joint Economic Committee about the central bank’s economic outlook and the FOMC will release minutes from its most recent policy meeting.

MCX June gold futures may open today’s session near Rs 26100 levels with resistance near Rs 26200-300 and support near Rs 25950.

Source by Commodity Insights

Gold futures are trading lower as the equities cheered taking the Japanese stocks toward fresh multiyear highs on indication that the Federal Reserve Bank wasn’t close to slowing its asset purchases.

The rally in equity market has recently taken away the shine from gold as investors have taken away their money from gold and other commodities and have invested in the stock market.

U.S. stocks rose on Tuesday, with the Dow industrials and S&P 500 finishing at record highs, after comments from two Federal Reserve officials suggested that the central bank is not close to tapering its bond-buying program. The Dow Jones Industrial Average gained 52.30 points, or 0.3%, to end at 15,387.58, notching its 19th consecutive Tuesday rise. The S&P 500 index climbed 2.87 points, or 0.2%, to 1,669.16,

In Asia, the Nikkei Stock Average, which ended at multiyear highs in each of the last three trading sessions, climbed a further 1.1% to 15,555.82, while the broader Topix added 0.8%.

Gold for June delivery is trading down $2 at $ 1375 an ounce on the Comex division of the New York Mercantile Exchange. It shed $6.50, or 0.5%, to settle at $1,377.60 an ounce, paring losses that had taken prices to a low below $1,360.

On Tuesday, St. Louis Fed President James Bullard said the central bank should continue with its present bond-buying program and adjust the rate of purchases in view of incoming data on growth and inflation. In a separate speech, New York Fed President William Dudley said he’s not sure which way the Fed will adjust the size of its bond-purchase program.

The program has helped support gold as quantitative easing tends to pressure the dollar and can lead to inflation. Gold is often seen as a hedge against inflation.

Fed Chairman Ben Bernanke on Wednesday will testify before the Joint Economic Committee about the central bank’s economic outlook and the FOMC will release minutes from its most recent policy meeting.

MCX June gold futures may open today’s session near Rs 26100 levels with resistance near Rs 26200-300 and support near Rs 25950.

Source by Commodity Insights

Tuesday, May 21, 2013

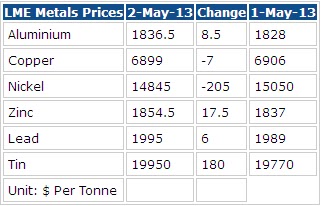

Aluminium Up By 1 Percent On LME

LME Aluminium has made some smart moves today and was up by 1 percent after the opening of European markets. The LME three month Aluminium prices were trading at $ 1863 per tonne, up from $ 1845 per tonne. On MCX, Aluminium was trading at Rs 101.85 per kg, up 0.4 percent.

Yesterday, International Aluminium Institute (IAI) said that the total world Aluminium production declined by 111000 tonnes in April to 3.745 million tonnes. The total world production in March was at 3.856 million tonnes. When compared to last year the production was up by 168000 tonnes to 3.577 million tonnes from April 2012.

LME inventories have increased by 0.29 percent so far this year and are at all time highs dragging Aluminium from every high though inventories declined by 5475 tonnes today to 5225650 tonnes.

Source by Commodity Insights

Monday, May 20, 2013

Gold Extends Rally; FOMC In Focus

Gold futures extended the rally towards $1400 an ounce in Asia electronic session today snapping a seven-session losing streak. The bullion traders are now focusing on FOMC meeting minutes

Gold for June delivery is trading up $6 at $ 1389 an ounce in Asia electronic session on the Comex division of the New York Mercantile Exchange. Yesterday, it settled up $19.40, or 1.4%, to $1,384.10 an ounce after tapping a low below $1,340.

Gold prices dropped sharply during the Asian trading session as investors continued to sell the precious metal amid speculation over an earlier-than-expected end to the Federal Reserve’s quantitative easing program.

Gold prices have fallen about 6% this month following April’s loss of 7.8% with the market hurt by constant outflows from gold-backed exchange-traded funds, including SPDR Gold Trust.

Sentiment on the precious metal was expected to remain bearish after data showed investors held 74,432 short contracts on gold, the highest level since June 2006.

Gold traders are now looking ahead to Wednesday’s Federal Reserve minutes, as well as testimony on the economic outlook and monetary policy by Fed Chairman Ben Bernanke.

Elsewhere on the Comex, silver for July delivery fell 3.7% to trade at $21.52 a troy ounce.

Silver futures were down by as much as 9.5% earlier in the session to hit a daily low of $20.21 a troy ounce, the weakest level since September 14, 2010.

According to some market participants, silver’s plunge was triggered by a sudden move higher in the yen during early Asian trading hours. The yen found support after Japan’s Economy Minister Akira Amari indicated that the yen’s correction from excessive strength was almost over and said that further yen weakness could have a negative impact on Japan’s economy.

MCX June gold futures may open today’s session above Rs 26000 with resistance near Rs 26100-200 levels.

Source by Commodity Insights

Gold Smashed, Smart Intraday Recovery Offers Support Though

Gold.......

slipped perilously close to Rs 25000, mimicking its last month's moves as the metal was hurt yet again in the global markets. COMEX Gold tanked towards its previous month's lows yet again, toppling to a low of $1336.30 per ounce before edging up in afternoon. The metal is currently trading at $1356.40, down $8.30 per ounce on the day. The commodity has shed nearly $150 in the last three weeks.

Meanwhile, the Euro remained pressed though the single currency managed to bounce from its six week lows against the US dollar. European leaders gather this week for a summit, which is likely to focus on the rampant unemployment in the region and the deepening recession. The one-day talks on Wednesday were dedicated weeks ago to the political fight to uncover unpaid taxes hidden away in Swiss or even EU bank vaults. When the leaders gather at the European Union headquarters in Brussels, overshadowing the talks will be the bloc's 26 million jobless and the eurozone's longest recession in history - 18 months and counting. This is likely to keep the recovery in Euro muted.

Meanwhile, the dollar has been supported on ideas that the Fed would be looking to cut back on its asset purchases at a optimal time in case the economic signs warrant. Dollar index shot up to a ten month high last week, sending Gold prices for a toss. The World Gold Council (WGC) reported that a rise in physical gold demand failed to offset outflows from gold-exchanged traded funds in the first quarter of the current year. Investors didn't buy enough physical gold to offset outflows from gold-exchanged traded funds in the first quarter, but total ETF gold holdings were still higher than a year ago, and demand for jewelry, bars and coins grew a lot thanks to China and India, a report from the World Gold Council released last week showed.

The WGC noted that total jewelry demand climbed 12% in the first quarter, compared with the same time a year ago. Jewelry demand from China and India soared by 19% and 15% respectively. However, total world gold demand was 963 metric tons in the first quarter, down 13% from the same time a year ago and 19% below the fourth quarter of 2012, according to the WGC report.

The Asian equity markets came of their highs today and a similar undertone in being witnessed in European stocks too. Investors seem to be getting a little nervous as global equities linger around their five-year highs and this is in turn supporting Gold. Indeed, the metal went up nearly 20 dollars in intraday moves today. The local spot markets could also witness a pick up in demand soon the spot prices fall near the previous month's lows. The MCX Gold futures for June are trading at Rs 25615 per 10 grams, down Rs 220 per 10 grams or 0.85% on the day. Prices slipped to a low of Rs 25373 per 10 grams earlier in the session.

slipped perilously close to Rs 25000, mimicking its last month's moves as the metal was hurt yet again in the global markets. COMEX Gold tanked towards its previous month's lows yet again, toppling to a low of $1336.30 per ounce before edging up in afternoon. The metal is currently trading at $1356.40, down $8.30 per ounce on the day. The commodity has shed nearly $150 in the last three weeks.

Meanwhile, the Euro remained pressed though the single currency managed to bounce from its six week lows against the US dollar. European leaders gather this week for a summit, which is likely to focus on the rampant unemployment in the region and the deepening recession. The one-day talks on Wednesday were dedicated weeks ago to the political fight to uncover unpaid taxes hidden away in Swiss or even EU bank vaults. When the leaders gather at the European Union headquarters in Brussels, overshadowing the talks will be the bloc's 26 million jobless and the eurozone's longest recession in history - 18 months and counting. This is likely to keep the recovery in Euro muted.

Meanwhile, the dollar has been supported on ideas that the Fed would be looking to cut back on its asset purchases at a optimal time in case the economic signs warrant. Dollar index shot up to a ten month high last week, sending Gold prices for a toss. The World Gold Council (WGC) reported that a rise in physical gold demand failed to offset outflows from gold-exchanged traded funds in the first quarter of the current year. Investors didn't buy enough physical gold to offset outflows from gold-exchanged traded funds in the first quarter, but total ETF gold holdings were still higher than a year ago, and demand for jewelry, bars and coins grew a lot thanks to China and India, a report from the World Gold Council released last week showed.

The WGC noted that total jewelry demand climbed 12% in the first quarter, compared with the same time a year ago. Jewelry demand from China and India soared by 19% and 15% respectively. However, total world gold demand was 963 metric tons in the first quarter, down 13% from the same time a year ago and 19% below the fourth quarter of 2012, according to the WGC report.

The Asian equity markets came of their highs today and a similar undertone in being witnessed in European stocks too. Investors seem to be getting a little nervous as global equities linger around their five-year highs and this is in turn supporting Gold. Indeed, the metal went up nearly 20 dollars in intraday moves today. The local spot markets could also witness a pick up in demand soon the spot prices fall near the previous month's lows. The MCX Gold futures for June are trading at Rs 25615 per 10 grams, down Rs 220 per 10 grams or 0.85% on the day. Prices slipped to a low of Rs 25373 per 10 grams earlier in the session.

Source by Commodity Insights

Lead Trying To Garner Support At 10 Day EMA

Lead.......

Lead.......

Multi Commodity Exchange Lead prices are trying to gather support at 10 day exponential moving average. Lead has crumbled in the last few days on the back of volatility in Dollar and the fact that international commodities buyers are reprieving from any buying.

Lead 10 day EMA was at Rs 109.7 per kg which it tested but bounced back marginally. The May expiry contract was at Rs 109.9 per kg when last seen. If the prices breach this level it can slip towards Rs 107.2 per kg.

Volumes have been quite dull in lead over the last few trading sessions. Lead volumes are at 12285 kgs while open interest is at 4870 contract against 4340 contract at the end of last week.

Source by Commodity Insights

Sunday, May 19, 2013

Copper Performance Marred By Chinese Concerns

Copper.......

LME three month prices of Copper were lower on the back of weak Chinese production data and concerns on economic slowdown in the country. Chinese banks are refraining from giving letter of credit to small copper imports thereby halting the funding. This not only is impacting the imports it is also quite negative from the value point of view.

LME three month prices of Copper were lower on the back of weak Chinese production data and concerns on economic slowdown in the country. Chinese banks are refraining from giving letter of credit to small copper imports thereby halting the funding. This not only is impacting the imports it is also quite negative from the value point of view.

LME three month prices of Copper were lower on the back of weak Chinese production data and concerns on economic slowdown in the country. Chinese banks are refraining from giving letter of credit to small copper imports thereby halting the funding. This not only is impacting the imports it is also quite negative from the value point of view.

LME three month prices of Copper were lower on the back of weak Chinese production data and concerns on economic slowdown in the country. Chinese banks are refraining from giving letter of credit to small copper imports thereby halting the funding. This not only is impacting the imports it is also quite negative from the value point of view.

Meanwhile other problem with metals is the attractiveness of equities over commodities at current juncture. Oversupply burden has already chopped Copper to 18 month lows earlier this year. LME Copper inventories closed at 629950 tonnes against 606700 tonnes at the beginning of the week, up 3.8 percent.

LME Copper was trading at $ 7270 per tonne on Monday, against $ 7349.5 per tonne last week. Most active Copper contract on MCX closed the last week trading at Rs 405.6 per kg, up 0.1 percent in the week. Downtrend can take Copper towards Rs 401 per kg in the upcoming trading sessions. Resistance for the contract is at Rs 409 per kg.

Last week, COMEX Copper fund managers, Commitment of traders report for week ending 14 May 2013 showed decline in the short positions while there was concurrent minor increase of long positions by hedge fund managers. The total short positions declined by 3064 contracts taking total short contracts number to 40667 contracts from 43731 contracts in the previous week.

COT report showed that long contracts increased by 568 contracts and were at 27503 contracts from 26935 contracts a week before. Total net short positions therefore moved to 13164 contracts on 14 May from 16796 contracts a week before.

Source by Commodity Insights

Gold Goes Bumptey Bump

Gold.......

Gold futures went bumpety bump in Asia electronic trades Monday extending its decline to eighth consecutive session. The counter may find a support near $ 1335-1320 levels and resistance near $1395 levels in the near term.

Gold futures went bumpety bump in Asia electronic trades Monday extending its decline to eighth consecutive session. The counter may find a support near $ 1335-1320 levels and resistance near $1395 levels in the near term.

Gold futures went bumpety bump in Asia electronic trades Monday extending its decline to eighth consecutive session. The counter may find a support near $ 1335-1320 levels and resistance near $1395 levels in the near term.

Gold futures went bumpety bump in Asia electronic trades Monday extending its decline to eighth consecutive session. The counter may find a support near $ 1335-1320 levels and resistance near $1395 levels in the near term.

Gold futures for June delivery are trading down $ 21 at $1344 an ounce on the Comex division of the New York Mercantile Exchange. It plunged 2.1% on Friday to settle the week at $1,357.75 a troy ounce. On the week, gold futures lost 6.1%, the second consecutive weekly decline.

It tumbled to a one-month low on Friday as investors continued to speculate over an earlier-than-expected end to the Federal Reserve’s quantitative easing program. Moves in the gold price this year have largely tracked shifting expectations as to whether the U.S. central bank would end its bond-buying program sooner-than-expected.

The dollar index, which tracks the performance of the greenback against a basket of six other major currencies, rose 0.5% on Friday to settle the week at 84.34, the strongest level since July 2010. The Fed is currently running a USD85 billion monthly asset-purchasing program, which weakens the greenback to spur recovery.

Sentiment on the precious metal was further dampened after quarterly financial filings released earlier in the week showed that hedge fund billionaire George Soros cut his holdings of gold-backed exchange-traded products in the first quarter. Funds run by Blackrock and Northern Trust also showed reductions, underlining concerns that investment demand is fading as U.S. stock market rallies to all-time highs.

MCX June gold may open today’s session near Rs 25750 levels with support around Rs 25650-600 levels.

Source by Commodity Insights

Saturday, May 18, 2013

Economic Buzz: BOC Core CPI Rises 1.10% In April, Less Than Prior Month Inflation

The Bank of Canada core consumer price index gained 1.10% in April

month, after gaining 1.40% in the last month and against the expectation

of increase of 1.20%.

Source by Commodity Insights

Source by Commodity Insights

Friday, May 17, 2013

Oil Stays Under Pressure

Oil......

The U.S. dollar strengthened Friday, trading at its best levels in 10 months after a Federal Reserve official projected the possible timing of a winding down of the Fed’s bond buying. The ICE dollar index, which measures the greenback’s movement against six other major currencies, sat at 83.895, up from 83.758 on Thursday.

The U.S. dollar strengthened Friday, trading at its best levels in 10 months after a Federal Reserve official projected the possible timing of a winding down of the Fed’s bond buying. The ICE dollar index, which measures the greenback’s movement against six other major currencies, sat at 83.895, up from 83.758 on Thursday.

Crude oil futures stayed under pressure hovering in the range of $92-97 a barrel since last 2 weeks, fixed between the rising dollar and the rally in equity market.

The U.S. dollar strengthened Friday, trading at its best levels in 10 months after a Federal Reserve official projected the possible timing of a winding down of the Fed’s bond buying. The ICE dollar index, which measures the greenback’s movement against six other major currencies, sat at 83.895, up from 83.758 on Thursday.

The U.S. dollar strengthened Friday, trading at its best levels in 10 months after a Federal Reserve official projected the possible timing of a winding down of the Fed’s bond buying. The ICE dollar index, which measures the greenback’s movement against six other major currencies, sat at 83.895, up from 83.758 on Thursday.

The greenback fell during Thursday’s session following a climb in U.S. weekly jobless claims, mixed signals from the housing market, and data showing conditions in the Philadelphia region’s manufacturing sector worsened this month.

The ICE dollar index was on track for a rise of roughly 1% for the week, benefitting in part from a fall in the euro after disappointing first-quarter gross domestic product reports from France, Germany and the euro zone.

Crude oil for June delivery is trading down 17 cents at $ 94.99 per barrel on the New York Mercantile Exchange. It settled up 86 cents, or 0.9%, to $95.16 a barrel.

Prices had been trading higher, then briefly turned lower after the Philadelphia Federal Reserve said its business-conditions index sank to -5.2 from 1.3 in April.

Earlier Thursday, the Labor Department said the consumer-price index fell by a seasonally adjusted 0.4%. The inflation rate over the past 12 months fell to 1.1% in April, marking the lowest level since November 2010.

Separately, the Labor Department said initial jobless claims climbed by 32,000 to a seasonally adjusted 360,000 in the week ended May 11, compared with economists’ expectations for a rise to 330,000.

MCX May crude oil futures may open today’s session near Rs 5190 levels with support around Rs 5170-5140 levels.

Source by Commodity Insights

Thursday, May 16, 2013

Commodities Buzz: Chinese Soybean Imports Seen At 66 Million Tonnes

China's soybean imports are expected to reach record highs in the

coming year, according to forecasts released on Wednesday by the China

National Grain and Oils Information Center. China- already the world's

largest soybean importing country is expected to import 66 million

metric tons during the 2013-14-market year (September 2013 to August

2014).

In 2012, China's soybean imports soared by 11.2% from the previous year to 58.4 million tons. The US Department of Agriculture recently predicted China's imports of the beans will jump to 69 million tons during the period, while putting import volumes for the current market year at 59 million tons. The size of Chinese imports is viewed as a key influence on soybean price potential, especially towards the end of the year when the US, which normally has a seasonal dominance in world exports, will face enhanced South American competition.

According to the center's figures, the country's soybean production this year is likely to drop by 3.9% from a year ago to 12.3 million tons, which would mark the third year running of reduced output. The amount of area dedicated to growing the beans is also expected to decline, by 3.7%, the center said, after the area shrank by 14.4% the previous year.

Source by Commodity Insights

In 2012, China's soybean imports soared by 11.2% from the previous year to 58.4 million tons. The US Department of Agriculture recently predicted China's imports of the beans will jump to 69 million tons during the period, while putting import volumes for the current market year at 59 million tons. The size of Chinese imports is viewed as a key influence on soybean price potential, especially towards the end of the year when the US, which normally has a seasonal dominance in world exports, will face enhanced South American competition.

According to the center's figures, the country's soybean production this year is likely to drop by 3.9% from a year ago to 12.3 million tons, which would mark the third year running of reduced output. The amount of area dedicated to growing the beans is also expected to decline, by 3.7%, the center said, after the area shrank by 14.4% the previous year.

Source by Commodity Insights

Wednesday, May 15, 2013

Economic Buzz: South Korea Unemployment Rate Falls In April

Unemployment rate in South Korea declined in April, the latest figures from Statistics Korea showed Wednesday. The seasonally adjusted jobless rate fell to 3.1 percent in April from 3.2 percent in March. The unadjusted rate was at 3.2 percent, down from 3.5 percent in March.

The number of unemployed persons declined to 825,000 from 883,000 in March. Unemployment decreased 7.8 percent year-on-year. Meanwhile, employment rose to 25.1 million from 24.5 million in the previous month. This was 1.4 percent higher than last year.

Source by Commodity Insights

Copper Higher After Sell Off On Tuesday

Copper.........

Copper prices are mostly higher on the London Metal Exchange, with investors buying at lower levels following a heavy selloff Tuesday that was driven by bearish data from China, the world's top base metals consumer.

Copper prices are mostly higher on the London Metal Exchange, with investors buying at lower levels following a heavy selloff Tuesday that was driven by bearish data from China, the world's top base metals consumer.

Copper prices are mostly higher on the London Metal Exchange, with investors buying at lower levels following a heavy selloff Tuesday that was driven by bearish data from China, the world's top base metals consumer.

Copper prices are mostly higher on the London Metal Exchange, with investors buying at lower levels following a heavy selloff Tuesday that was driven by bearish data from China, the world's top base metals consumer.

Three-month copper is trading at $ 7241 a metric ton, up $ 16 per tonne from its previous settlement. Copper had tested a one month high of $ 7378 per tonne this week before turning down after China industrial production data. Among other metals, Three-month nickel forwards were down $ 30 per tonne at $15150 per ton.

In currency markets, US Dollar was sideways at 1.2935 on Wednesday against 1.2931 last night versus the Euro. Data from Europe missed the expectations of traders. ZEW index of German economic sentiment rose to 36.4 in May from 36.3 in April, well below expectations for a reading of 38.3.

Meanwhile, Eurostat, the European Union's statistics office, reported that industrial production in the euro area rose by 1% in March from February.

Meanwhile, world major copper mine Freeport reported a collapse in a training area deep underground at Big Gossan Mine in Grasberg. Spokesperson of the company has said that the rescue process can take some time to complete.

Indian Copper have taken a sharp turn on the downside and breached Rs 400 per kg levels to close at Rs 399.8 per kg. The prices tested a low of Rs 398.2 per kg and were down by 2.2 percent at the closing tick. Further correction can take prices towards Rs 395 per kg.

Source by Commodity Insights

Monday, May 13, 2013

Economic Buzz: New Zealand Q1 Retail Sales Falls Short Of Estimates

Real retail sales in New Zealand, when the effect of price changes is removed, gained 0.5 percent in the first quarter compared to the previous three months, Statistics New Zealand said on Tuesday, with sales volumes rising in 10 of the 15 retail industries. The headline figure was shy of forecasts for a gain of 0.8 percent following the 2.1 percent increase in the fourth quarter of 2012. The warmer-than-usual start to autumn has weakened clothing and footwear sales, Statistics New Zealand said today. Looking at the longer-term picture, the trends for both total retail sales values and volumes have been generally rising since mid-2009, after a period of sharp decline.

Source by Commodity Insights

Economic Buzz: U.K. RICS House Price Balance Up 1%

The RICS said that U.K. RICS house price balance rose to a seasonally adjusted 1% during April, from -2% in the preceding month whose figure was revised down from -1%.Analysts had expected U.K. RICS house price balance to rise to 2% last month.

Source by Commodity Insights

Economic Buzz: U.S. Core Retail Sales Improve In April

| The U.S. Commerce Department said that retail sales inched up by a seasonally adjusted 0.1% in April, confounding expectations for a 0.3% decline. Retail sales fell by 0.5% in March, whose figure was downwardly revised from a 0.4% drop. Core retail sales, which exclude automobile sales, fell by a seasonally adjusted 0.1% last month, in line with expectations. Core sales in March fell by 0.4%. Source by Commodity Insights |

Sunday, May 12, 2013

Economic Buzz: China Industrial Production Rises 9.30%

| National Bureau of Statistics of China said that Chinese Industrial Production rose to 9.3% in April 2013, from 8.9% in the preceding month. Analysts had expected Chinese Industrial Production to rise to 9.5% last month.Source by Commodity Insights |

Economic Buzz: New Zealand Food Prices Up 0.2% In April

Food prices in New Zealand added a seasonally adjusted 0.2 percent on month in April, Statistics New Zealand said on Monday, following the 1.3 percent contraction in March. In April, fruit and vegetable prices increased 1.0 percent.

On a yearly basis, food prices were down 0.1 percent after easing a revised 0.3 percent in the previous month.

Source by Commodity Insights

Aluminium and Aluminium Product Imports In China Decline In April

Aluminium ......

The Aluminium and Aluminium product imports in China declined to multi month low levels as per the data from China General Administration of Customs. The report showed that the Aluminium imports were 64134 tonnes in April 2013, down 8.2 percent from last month levels of 69845 tonnes. The decline was more denting on a yearly basis by 32 perce

nt from 94352 tonnes in April 2012.

Source by Commodity Insights

The Aluminium and Aluminium product imports in China declined to multi month low levels as per the data from China General Administration of Customs. The report showed that the Aluminium imports were 64134 tonnes in April 2013, down 8.2 percent from last month levels of 69845 tonnes. The decline was more denting on a yearly basis by 32 perce

Source by Commodity Insights

Friday, May 10, 2013

Economic Buzz: Canadian Unemployment Rate Remains Steady At 7.20%

Statistics Canada said that Canadian unemployment rate remained unchanged at a seasonally adjusted 7.2% in April 2013, from 7.2% in the preceding month. Analysts had expected Canadian unemployment rate to fall to 7.0% last month.

Source by Commodity Insights

Economic Buzz: Indian Industrial Production Rises 2.50% In March

Ministry of Statistics and Programme Implementation said that Indian Industrial Production rose to a seasonally adjusted 2.5%, from 0.6% in the preceding month.Analysts had expected Indian Industrial Production to rise to 2.0% last month. The cumulative growth for the period April-March 2012-13 over the corresponding period of the previous year stands at 1.0%.

The Indices of Industrial Production for the Mining, Manufacturing and Electricity sectors for the month of March 2013 stand at 145.3, 205.0 and 164.2 respectively, with the corresponding growth rates of (-) 2.9%, 3.2% and 3.5% as compared to March 2012. The cumulative growth in the three sectors during April-March 2012-13 over the corresponding period of 2011-12 has been (-) 2.5%, 1.2% and 4.0% respectively.

As per Use-based classification, the growth rates in March 2013 over March 2012 are 2.6% in Basic goods, 6.9% in Capital goods and (-) 0.2% in Intermediate goods. The Consumer durables and Consumer non-durables have recorded growth of (-) 4.5% and 6.5% respectively, with the overall growth in Consumer goods being 1.6%.

Source by Commodity Insights

Thursday, May 9, 2013

Gold Extends Losses As Dollar Sharpens

Gold......

Gold futures extended losses below $1460 an ounce in the Asia electronic session today as the US dollar sharpened above 100 yen level for the first time in four years.

Gold futures extended losses below $1460 an ounce in the Asia electronic session today as the US dollar sharpened above 100 yen level for the first time in four years.

Gold futures extended losses below $1460 an ounce in the Asia electronic session today as the US dollar sharpened above 100 yen level for the first time in four years.

Gold futures extended losses below $1460 an ounce in the Asia electronic session today as the US dollar sharpened above 100 yen level for the first time in four years.

Yesterday, the U.S. dollar rose above the 100 Japanese-yen-level on as recent stronger data points have eased investors’ fears about U.S. economic growth.

The dollar bought ¥101.16, up from late Thursday’s level of ¥100.48. The dollar managed to bounce above the ¥100 threshold after Thursday’s release of weekly U.S. jobless data, which came in better than anticipated.

Gold for June delivery is trading down $8.8 at $ 1459.8 per ounce on the Comex division of the New York Mercantile Exchange. Yesterday, it fell $5.10, or 0.4%, to settle at $1,468.60 an ounce. Gold on Wednesday climbed $24.90, or 1.7%, to $1,473.70.

The dollar’s climb toward the ¥100 mark had accelerated after Japan’s central bank in early April unveiled a massive stimulus program, but greenback kept running into resistance in its tests of the triple-digit mark until Thursday.

The Aussie was little changed Friday after the Reserve Bank of Australia cut its 2013 inflation forecast, seeing the level at about 2.25% compared with its previous view of 2.5%. In a statement about monetary policy, the RBA also said it expects economic growth to be a little below trend over the rest of this year, before picking up pace through 2014. Earlier this week, the RBA cut its key interest rate by a quarter-percentage point to a record low 2.75%.

The euro traded at $1.3040, little changed from $1.3038 late Thursday. The British pound was also flat against the greenback Friday from late Thursday’s level of $1.5442.

MCX June bullion may open today’s session near Rs 27050 levels with support near Rs 27000 and Rs 26900 levels and resistance near Rs 27110 levels.

Source by Commodity Insights

Wednesday, May 8, 2013

Economic Buzz: Australia's April Unemployment Rate Falls

Australian Bureau of Statistics said that Australian unemployment rate fell to a seasonally adjusted 5.5%, from 5.6% in the preceding month. Analysts had expected Australian unemployment rate to remain unchanged at 5.6% last month.

Source by Commodity Insights

Tuesday, May 7, 2013

Commodities Buzz: Global Rapeseed Supplies To Be Tighter In Next Year

The group flagged a severe deterioration in the UK owing to detrimental weather conditions resulting in the abandonment of at least 200,000 hectares of winter rapeseed area.Rapeseed prices are expected to outperform soybean prices over the nest few months, a latest update from the Oil World states. The group downgraded prospects for the European Union harvest, and cutting to a forecast for the UK harvest, which met with skepticism when it was made last week.

The influential analysis group said that rapeseed supplies would be tighter than previously expected in 2013-14, thanks to the weakened harvest prospects in the EU, the top consumer of the oilseed.

Oil World cut to 19.8 million (m) tonnes its estimate for the EU harvest, from 20.2m tonnes a week ago, albeit still representing an increase from last year's 19.2m-tonne harvest.

The deteriorated rapeseed production prospects in the EU are likely to be a supportive element for rapeseed prices, which also may widen their premium over soybeans. The group warned about a severe deterioration in the UK owing to detrimental weather conditions resulting in the abandonment of at least 200,000 hectares of winter rapeseed area.

The influential analysis group said that rapeseed supplies would be tighter than previously expected in 2013-14, thanks to the weakened harvest prospects in the EU, the top consumer of the oilseed.

Oil World cut to 19.8 million (m) tonnes its estimate for the EU harvest, from 20.2m tonnes a week ago, albeit still representing an increase from last year's 19.2m-tonne harvest.

The deteriorated rapeseed production prospects in the EU are likely to be a supportive element for rapeseed prices, which also may widen their premium over soybeans. The group warned about a severe deterioration in the UK owing to detrimental weather conditions resulting in the abandonment of at least 200,000 hectares of winter rapeseed area.

Source by Commodity Insights

Monday, May 6, 2013

Commodities Buzz: Baoshan Iron And Steel Completes Output Of 80 Percent Of Share Buyback Program

Baoshan Iron and Steel Co (Baosteel), China's largest listed steel maker by output, has completed nearly 80 percent of the 5-billion yuan ($811 million) share buyback program it initiated in September 2012, the company announced Monday in its latest update on the matter.

As of May 2, Baosteel had spent 3.85 billion yuan repurchasing 807 million of its own shares at prices ranging from 4.51 yuan to 5 yuan each, according to a filing the steel maker made to the Shanghai Stock Exchange Monday.

Source by Commodity Insights

Economic Buzz: Australia Q1 House Price Index Up 2.60%

| Preliminary estimates show that the price index for established houses in Australia for the weighted average of the eight capital cities rose 2.6% in the year to the March quarter 2013. Source by Commodity Insights |

Economic Buzz: Euro Zone Service And Manufacturing Sector Contracts

The Euro zone composite final Markit PMI output is at 46.9 in April, up fromMarch's four-month low of 46.5, the Eurozone PMI Composite Output Indexwas slightly above its earlier flash estimate of 46.5. Eurozone manufacturingproduction and service sector business activity both contracted at similarlymarked rates in April.

Overall output has now declined throughout the past 15 months, although the easing in the rate of decline signaled by the headline index was the first since January. Eurozone manufacturing production and service sector business activity both contracted at similarly marked rates in April. Output contracted across the four largest euro nations. Ongoing steep downturns were signaled in Spain, France and Italy, although rates of decline eased in the latter two. Germany also slipped back into contraction for the first time since November 2012, with renewed declines signaled by manufacturers and service providers alike. Growth strengthened in Ireland, as a solid upturn in the service sector offset weakness at manufacturers.

Source by Commodity Insights

Sunday, May 5, 2013

Commodities Buzz: China Nonferrous Metal Producers Face Declining Profits

Fifty-five of the 74 A-share listed Chinese nonferrous metal producers which released financial reports for 2012, said they saw declining net profits due to cooling market demand amid slowed economic growth.

Another 11 reported losses in 2012, according to data Chinese financial information provider. Analysts said the increasing cost of production; large inventories and shrinking demand were the major reasons.

Source by Commodity Insights

Saturday, May 4, 2013

Economic Buzz: U.S. Trade Deficit Eases In March

The

U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through

the Department of Commerce, announced on Friday that total March exports

of $184.3 billion and imports of $223.1 billion resulted in a goods and

services deficit of $38.8 billion, down from $43.6 billion in February,

revised. March exports were $1.7 billion less than February exports of

$186.0 billion. March imports were $6.5 billion less than February

imports of $229.6 billion.

Source by Commodity Insights

Source by Commodity Insights

Friday, May 3, 2013

MCX Weekly Review: COMDEX Slips More Than 2%

MCX Comdex was down by 2.03% to 3466.27 for the week till Thursday. MCX Metal was down by 2.79% to 4379.78 and MCX Energy was down by 1.12% to 3537.60.

Bullion:

Gold June 13 contract was down by 0.47% to Rs 26914 per 10 grams, Gold M July 13 contract was down by 0.66% to Rs 27042 per 10 grams, Goldguinea May 13 contract was down by 0.73% to Rs 21533 per 8 grams, gold Petal May 13 contract was down by 0.70% to Rs 2691 per gram and Gold Petal Del May 13 contract was down by 0.44% to Rs 2720 per gram. Silver July 13 contract was down by 2.51% to Rs 44633 per kg, Silver M June 13 contract was down by 2.51% to Rs 44668 per kg, Silver MIC June 13 contract was down by 2.50% to Rs 44675 per kg and silver1000 June 13 contract was down by 1.27% to Rs 44288 per kg.

Metals:

Steel RPR May 13 contract was up by 0.79% to Rs 27910.00 per MT while Aluminum May 13 contract was down by 7.42% to Rs 97.30 per kg, Alumini May 13 contract was down 7.47% to Rs 97.30 per kg, lead May 13 contract was down by 6.97% to Rs 104.80 per kg, Lead Mini May 13 contract was down by 6.93% to Rs 104.80 per kg, zinc May 13 contract was down by 6.36% to Rs 97.90 per kg, zinc mini May 13 contract was down by 6.36% to Rs 97.90 per kg, nickel July 13 contract was down by 5.97% to Rs 810.80 per kg, Nickel M July 13 contract was down by 5.69% to Rs 810.40 per kg, Copper June 13 contract was down by 5.32% to Rs 372.15 per kg, Copper M June 13 contract was down by 5.33% to Rs 372.10 per kg.

Energy:

Natural gas July 13 contract was down by 5.61% to Rs 223.80 per MMBTU, Brent crude oil May 13 contract was down by 1.91% to Rs 5490.00 per barrel and Crude oil June 13 contract was down by 0.94% to Rs 5046.00 per barrel.

Agri Commodities:

Bullion:

Gold June 13 contract was down by 0.47% to Rs 26914 per 10 grams, Gold M July 13 contract was down by 0.66% to Rs 27042 per 10 grams, Goldguinea May 13 contract was down by 0.73% to Rs 21533 per 8 grams, gold Petal May 13 contract was down by 0.70% to Rs 2691 per gram and Gold Petal Del May 13 contract was down by 0.44% to Rs 2720 per gram. Silver July 13 contract was down by 2.51% to Rs 44633 per kg, Silver M June 13 contract was down by 2.51% to Rs 44668 per kg, Silver MIC June 13 contract was down by 2.50% to Rs 44675 per kg and silver1000 June 13 contract was down by 1.27% to Rs 44288 per kg.

Metals:

Steel RPR May 13 contract was up by 0.79% to Rs 27910.00 per MT while Aluminum May 13 contract was down by 7.42% to Rs 97.30 per kg, Alumini May 13 contract was down 7.47% to Rs 97.30 per kg, lead May 13 contract was down by 6.97% to Rs 104.80 per kg, Lead Mini May 13 contract was down by 6.93% to Rs 104.80 per kg, zinc May 13 contract was down by 6.36% to Rs 97.90 per kg, zinc mini May 13 contract was down by 6.36% to Rs 97.90 per kg, nickel July 13 contract was down by 5.97% to Rs 810.80 per kg, Nickel M July 13 contract was down by 5.69% to Rs 810.40 per kg, Copper June 13 contract was down by 5.32% to Rs 372.15 per kg, Copper M June 13 contract was down by 5.33% to Rs 372.10 per kg.

Energy:

Natural gas July 13 contract was down by 5.61% to Rs 223.80 per MMBTU, Brent crude oil May 13 contract was down by 1.91% to Rs 5490.00 per barrel and Crude oil June 13 contract was down by 0.94% to Rs 5046.00 per barrel.

Agri Commodities:

Cardamom June 13 contract was up by 1.95% to Rs 792.80 per kg, Cotton July 13 contract was up by 0.88% to Rs 18340.00 per bale while Potato July 13 contract was down by 6.70% to Rs 951.20 per 100 kgs, Menthaoil May 13 contract was down by 3.83% to Rs 919.10 per kg, CPO May 13 contract was down by 1.13% to Rs 454.70 per 10 kgs, Kapaskhali May 13 contract was down by 0.35% to Rs 1419.50 per 100 kgs.

Powered by Commodity Insights

Thursday, May 2, 2013

MCX Gold Races Higher On Solid Fresh Buying

Gold....

MCX Gold futures raced higher in tune with the global cues today as buying

interest returned after a massive slide in the last session. Gold

slipped for a third session yesterday as traders locked further gains

after recent array of gains ahead of the US FOMC meet. COMEX futures had

edged up above $1470 per ounce earlier in the week but failed to hold

on above the level as commodities witnessed yet another correction.

However, some buying is emerging now as investors get over the latest

FOMC statement and wait for the European banks turn today. COMEX Gold is

quoting at $1454.40, up $8.20 per ounce on the day.

MCX Gold futures raced higher in tune with the global cues today as buying

interest returned after a massive slide in the last session. Gold

slipped for a third session yesterday as traders locked further gains

after recent array of gains ahead of the US FOMC meet. COMEX futures had

edged up above $1470 per ounce earlier in the week but failed to hold

on above the level as commodities witnessed yet another correction.

However, some buying is emerging now as investors get over the latest

FOMC statement and wait for the European banks turn today. COMEX Gold is

quoting at $1454.40, up $8.20 per ounce on the day.

The European Central Bank decided to lower its benchmark interest rate by 25 basis points to 0.50%, very much as expected. However, since this was already factored in, Gold was sitting unmoved after the announcement. The Fed stated yesterday that information received since the Federal Open Market Committee met in March suggests that economic activity has been expanding at a moderate pace. Labor market conditions have shown some improvement in recent months, on balance, but the unemployment rate remains elevated.

Household spending and business fixed investment advanced, and the housing sector has strengthened further, but fiscal policy is restraining economic growth. Inflation has been running somewhat below the Committee's longer-run objective, apart from temporary variations that largely reflect fluctuations in energy prices. Longer-term inflation expectations have remained stable.

In fact, the Fed expects that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the asset purchase program ends and the economic recovery strengthens. This took aside the calls for an early end to the quantitative easing regime.

On Wednesday, China's official purchasing managers' index (PMI), which mainly focuses on the state-owned enterprise sector, fell to 50.6 in April from 50.9 in March, indicating a slowdown in manufacturing activity that was led by a slump in new export orders. A reading above 50 indicates expansion in the manufacturing sector while a reading below 50 means that manufacturing activity shrank.

Gold had tumbled in a freakish manner a few days back. There were concerns that debt stricken European country Cyprus might have to sell gold holdings to raise finances. Traders fear that this would load up supplies in global markets in the short term. Massive unloading in Gold ETF's was also responsible for the worst crash in gold prices for three decades.

Gold corrected more than 40 dollars in the current week before the current upswing. The US dollar slipped to its two month low against the Euro yesterday though some moderate gains have emerged in the currency today. MCX Gold futures broke under Rs 27000 per 10 grams this week and closed with heavy losses yesterday. The counter quotes at Rs 26706, up Rs 166 per 10 grams or 0.63% on the day with 7% increase in open interest indicating fresh buying.

Source by Commodity Insights

MCX Gold futures raced higher in tune with the global cues today as buying

interest returned after a massive slide in the last session. Gold

slipped for a third session yesterday as traders locked further gains

after recent array of gains ahead of the US FOMC meet. COMEX futures had

edged up above $1470 per ounce earlier in the week but failed to hold

on above the level as commodities witnessed yet another correction.

However, some buying is emerging now as investors get over the latest

FOMC statement and wait for the European banks turn today. COMEX Gold is

quoting at $1454.40, up $8.20 per ounce on the day.

MCX Gold futures raced higher in tune with the global cues today as buying

interest returned after a massive slide in the last session. Gold

slipped for a third session yesterday as traders locked further gains

after recent array of gains ahead of the US FOMC meet. COMEX futures had

edged up above $1470 per ounce earlier in the week but failed to hold

on above the level as commodities witnessed yet another correction.

However, some buying is emerging now as investors get over the latest

FOMC statement and wait for the European banks turn today. COMEX Gold is

quoting at $1454.40, up $8.20 per ounce on the day.The European Central Bank decided to lower its benchmark interest rate by 25 basis points to 0.50%, very much as expected. However, since this was already factored in, Gold was sitting unmoved after the announcement. The Fed stated yesterday that information received since the Federal Open Market Committee met in March suggests that economic activity has been expanding at a moderate pace. Labor market conditions have shown some improvement in recent months, on balance, but the unemployment rate remains elevated.

Household spending and business fixed investment advanced, and the housing sector has strengthened further, but fiscal policy is restraining economic growth. Inflation has been running somewhat below the Committee's longer-run objective, apart from temporary variations that largely reflect fluctuations in energy prices. Longer-term inflation expectations have remained stable.

In fact, the Fed expects that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the asset purchase program ends and the economic recovery strengthens. This took aside the calls for an early end to the quantitative easing regime.

On Wednesday, China's official purchasing managers' index (PMI), which mainly focuses on the state-owned enterprise sector, fell to 50.6 in April from 50.9 in March, indicating a slowdown in manufacturing activity that was led by a slump in new export orders. A reading above 50 indicates expansion in the manufacturing sector while a reading below 50 means that manufacturing activity shrank.

Gold had tumbled in a freakish manner a few days back. There were concerns that debt stricken European country Cyprus might have to sell gold holdings to raise finances. Traders fear that this would load up supplies in global markets in the short term. Massive unloading in Gold ETF's was also responsible for the worst crash in gold prices for three decades.

Gold corrected more than 40 dollars in the current week before the current upswing. The US dollar slipped to its two month low against the Euro yesterday though some moderate gains have emerged in the currency today. MCX Gold futures broke under Rs 27000 per 10 grams this week and closed with heavy losses yesterday. The counter quotes at Rs 26706, up Rs 166 per 10 grams or 0.63% on the day with 7% increase in open interest indicating fresh buying.

Source by Commodity Insights

Commodities Buzz: Glencore Xstrata New Scheme Of Merger Becomes Effective Now

Glencore

is pleased to announce that the New Scheme and the Merger have now

become effective and the entire issued ordinary share capital of Xstrata

is owned by the Glencore Group. Admission to trading of Xstrata Shares

on the London Stock Exchange's main market for listed securities and

listing of Xstrata Shares on the Official List of the UK Listing

Authority are expected to be cancelled with effect from 8.00 a.m.

(London time) on 3 May 2013. The official cancellation of the secondary

listing of the Xstrata Shares on the SIX Swiss Stock Exchange is

expected to take effect on, and including, 6 May 2013.

Source by Commodity Insights

Source by Commodity Insights

Commodities Buzz: ALCOA To Review Smelting Capacity Over Next 15 Months

Alcoa

announced that it will review 460000 metric tons of smelting capacity

over the next 15 months for possible curtailment to maintain the

Company's competitiveness, as aluminum prices have fallen more than 33

percent since their peak in 2011.

Alcoa

announced that it will review 460000 metric tons of smelting capacity

over the next 15 months for possible curtailment to maintain the

Company's competitiveness, as aluminum prices have fallen more than 33

percent since their peak in 2011.The review will include facilities across the Alcoa system and will focus on higher-cost plants and plants that have long-term risk due to factors such as energy costs or regulatory uncertainty. The possible curtailments could affect 11 percent of Alcoa's global smelting capacity. Currently, the Company has 13 percent, or 568,000 metric tons of smelting capacity idle.

“Because of persistent weakness in global aluminum prices, we need to review every option to maintain Alcoa's competitiveness,” said Chris Ayers, President of Alcoa's Global Primary Products. “Any action taken will only be done after a thorough strategic review and consultations with stakeholders.”

When reviewing smelting capacity for possible curtailment, Alcoa will consider a wide variety of alternative actions, ranging from discontinuing pot relining to full plant curtailments and/or permanent shutdowns. Alcoa's alumina refining system will also be reviewed to reflect any curtailments in smelting as well as prevailing market conditions.

Alcoa's review of its primary metals operations is consistent with the Company's 2015 goal of lowering its position on the world aluminum production cost curve by 10 percentage points and the alumina cost curve by 7 percentage points. Decisions on curtailments and/or closures will be announced as reviews are completed.

Source by Commodity Insights

Copper Lowest In 18 Months On Weaker Chinese Data

Copper......

LME

three month Copper forwards declined to the lowest levels in 18 months

after weaker than expected manufacturing data in China and US. LME

Copper three month prices declined by $ 210 per tonne to settle at $

6906 per tonne on 1 May 2013. Meanwhile, COMEX Copper contract declined

by 10.50 cents, or 3.3%, to settle at $3.0825 a pound on the Comex

division of the New York Mercantile Exchange.

LME

three month Copper forwards declined to the lowest levels in 18 months

after weaker than expected manufacturing data in China and US. LME

Copper three month prices declined by $ 210 per tonne to settle at $

6906 per tonne on 1 May 2013. Meanwhile, COMEX Copper contract declined

by 10.50 cents, or 3.3%, to settle at $3.0825 a pound on the Comex

division of the New York Mercantile Exchange.

Indian Copper prices declined by Rs 13 per kg to settle at Rs 367.95 per kg. The prices tested a intraday low of Rs 366 per kg. Further declines can take Copper towards Rs 355 per kg. Resistance for the contract is at Rs 370 per kg.

China Purchase Manager Index (PMI) declined to 50.6 in April from 50.9 in March. Meanwhile, U.S. manufacturing activity slowed to 50.7 in April from 51.3 in March, according to data from the Institute for Supply Management.

In another report, the International Copper Study Group said copper supply exceeded demand by 70,000 metric tons in January. The ICSG forecast that global copper consumption fell by 6% in January from a year earlier, with Chinese demand down 6.8% as net imports of copper declined.

Source by Commodity Insights

LME

three month Copper forwards declined to the lowest levels in 18 months

after weaker than expected manufacturing data in China and US. LME

Copper three month prices declined by $ 210 per tonne to settle at $

6906 per tonne on 1 May 2013. Meanwhile, COMEX Copper contract declined

by 10.50 cents, or 3.3%, to settle at $3.0825 a pound on the Comex

division of the New York Mercantile Exchange.

LME

three month Copper forwards declined to the lowest levels in 18 months

after weaker than expected manufacturing data in China and US. LME

Copper three month prices declined by $ 210 per tonne to settle at $

6906 per tonne on 1 May 2013. Meanwhile, COMEX Copper contract declined

by 10.50 cents, or 3.3%, to settle at $3.0825 a pound on the Comex

division of the New York Mercantile Exchange.Indian Copper prices declined by Rs 13 per kg to settle at Rs 367.95 per kg. The prices tested a intraday low of Rs 366 per kg. Further declines can take Copper towards Rs 355 per kg. Resistance for the contract is at Rs 370 per kg.

China Purchase Manager Index (PMI) declined to 50.6 in April from 50.9 in March. Meanwhile, U.S. manufacturing activity slowed to 50.7 in April from 51.3 in March, according to data from the Institute for Supply Management.

In another report, the International Copper Study Group said copper supply exceeded demand by 70,000 metric tons in January. The ICSG forecast that global copper consumption fell by 6% in January from a year earlier, with Chinese demand down 6.8% as net imports of copper declined.

Source by Commodity Insights

Subscribe to:

Posts (Atom)